Australia 200 Index – getting close to psychological price line

Australia 200 Index is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 5 days and may test it again within […]

Australia 200 Index – getting close to psychological price line

Australia 200 Index is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 5 days and may test it again within […]

FTSE China A50 Index – getting close to support of a Channel Down

FTSE China A50 Index is moving towards a support line. Because we have seen it retrace from this line before, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 5 days and may test it again within the […]

Should we expect a breakout or a rebound on Australia 200 Index?

The movement of Australia 200 Index towards the support line of a Channel Down is yet another test of the line it reached numerous times in the past. This line test could happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound […]

Should we expect a breakout or a rebound on Australia 200 Index?

The movement of Australia 200 Index towards the support line of a Channel Down is yet another test of the line it reached numerous times in the past. This line test could happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound […]

Should we expect a breakout or a rebound on FTSE China A50 Index?

The movement of FTSE China A50 Index towards the support line of a Falling Wedge is yet another test of the line it reached numerous times in the past. This line test could happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply […]

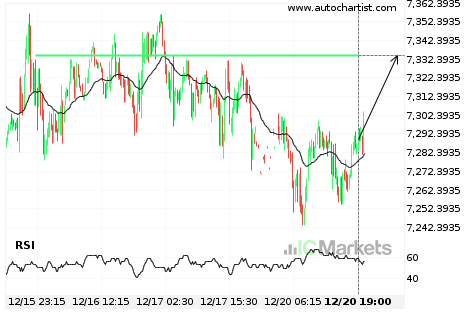

Australia 200 Index approaching resistance of a Channel Down

Australia 200 Index is approaching the resistance line of a Channel Down. It has touched this line numerous times in the last 9 days. If it tests this line again, it should do so in the next 2 days.

Australia 200 Index approaching resistance of a Channel Down

Australia 200 Index is approaching the resistance line of a Channel Down. It has touched this line numerous times in the last 9 days. If it tests this line again, it should do so in the next 2 days.

Should we expect a breakout or a rebound on Australia 200 Index?

The movement of Australia 200 Index towards the resistance line of a Channel Down is yet another test of the line it reached numerous times in the past. This line test could happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound […]

Should we expect a breakout or a rebound on Australia 200 Index?

The movement of Australia 200 Index towards the resistance line of a Channel Down is yet another test of the line it reached numerous times in the past. This line test could happen in the next 2 days, but it is uncertain whether it will result in a breakout through this line, or simply rebound […]